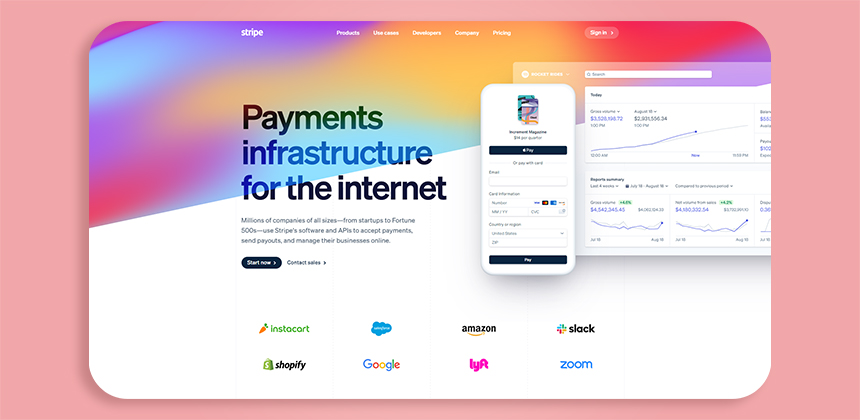

A new supported payment gateway, Stripe has become available in Syncee. Both retailers and suppliers can enjoy the advantages of this solution from now on.

With the integration of Stripe, retailers can enhance their checkout experience. It’s not just about accepting payments; it’s about creating a seamless transaction process that integrates with their existing online platforms. The hassle-free setup ensures that merchants can focus on selling rather than on technical issues.

Moreover, Stripe supports a wide array of payment methods, including Apple Pay, Google Pay, and local payment methods. This flexibility allows businesses to cater to a diverse customer base, which can significantly improve conversion rates and customer satisfaction.

In addition to its robust payment processing capabilities, Stripe offers valuable analytics tools that help businesses measure their sales performance and customer behaviors. Retailers can track which products are selling best, at what times, and from which channels, allowing them to make data-driven decisions to optimize their marketing strategies.

Stripe is one of the leading payment gateways on the market. As years go by, the popularity of their service is constantly growing all over the world.

The integration of Stripe in Syncee not only simplifies payment processing but also enhances security measures. With advanced fraud detection tools, retailers can feel confident that their transactions are safe, which is crucial in today’s digital marketplace.

Furthermore, Stripe’s ability to handle subscriptions and recurring billing makes it an ideal choice for businesses that offer subscription services. This feature allows retailers to easily manage customer subscriptions without additional software, streamlining operations significantly.

Stripe is a complete payments platform, founded in 2010 in the United States, and is dual-headquartered in San Francisco, US and Dublin, Ireland. By 2022, millions of businesses of all sizes, from startups to large enterprises, use this software and APIs to accept payments, send payouts, and manage business online.

Another significant advantage of using Stripe is its extensive documentation and support community. Retailers can easily access resources to troubleshoot issues or learn how to utilize Stripe’s features effectively, which can save time and reduce frustration.

Additionally, Stripe’s mobile payment capabilities allow retailers to accept payments via mobile devices, which is critical in an era where consumers increasingly shop on their smartphones. This mobile-first approach ensures that businesses do not miss out on potential sales.

For international businesses, Stripe’s support for multiple currencies is invaluable. It allows retailers to sell to a global audience without worrying about the complexities of currency conversion, which can often deter potential customers.

Moreover, the automation features provided by Stripe reduce the manual workload for retailers. Automated invoicing and payment reminders can keep businesses organized and improve cash flow management.

Stripe also provides customizable checkout experiences that retailers can adapt to match their brand identity, enhancing customer trust and loyalty. This level of personalization can lead to improved customer retention.

In summary, the advantages of integrating Stripe with Syncee are numerous and diverse. Retailers can leverage these features to not only accept payments but to vastly improve their overall ecommerce operations.

As we see a growing trend of entrepreneurs gravitating towards digital commerce, having a reliable payment gateway like Stripe integrated into their systems becomes imperative for success.

When considering payment gateways, it is essential for ecommerce operators to prioritize security, ease of use, and customer support, all of which are hallmarks of Stripe’s service.

Retailers should also consider the scalability of their payment solutions. As their business grows, Stripe’s infrastructure can handle increased transaction volumes without compromising efficiency.

Lastly, the robust reporting features allow retailers to stay informed about their revenue streams and sales trends, aiding them in making informed business decisions.

In conclusion, Stripe’s integration into Syncee opens up new avenues for retailers, allowing them to streamline their payment processes and enhance customer experience significantly.

As ecommerce continues to evolve, choosing the right payment gateway will be crucial for businesses looking to thrive in a competitive landscape.

Advantages of Stripe for Online Stores

Syncee has started to support this payment gateway as we noticed that a growing number of ecommerce entrepreneurs are looking for this solution to be able to manage payments. Stripe is mostly known among Shopify users in the field of ecommerce.

- Reasonable commission fees and pricing

- Decent currency conversion rates

- 135+ currencies accepted

- User-friendly, automated solutions

- Powerful and easy-to-use APIs

- Intelligent optimizations

- Battle-tested reliability

- Pre-built checkout

- Restricts less product categories than its biggest competitors

- 35+ countries with local acquiring, optimizing aceptance rates

- One of the fastest-improving platform, hundreds of features, improvements a year

- A complete payments platform, engineered for growth

- Several ways to integrate

- Outstanding, 24/7 customer support

We cannot say this or that payment gateway is better than the other. Everyone has to thoroughly check the services’ advantages, solutions and make a decision based on their own research.

Retailers looking for comprehensive solutions will find that Syncee, combined with Stripe, offers a powerful platform for managing their online sales effectively.

Utilizing the Auto Order feature, retailers can optimize their inventory management, ensuring that they are always stocked with the products their customers want, thus enhancing the overall shopping experience.

By simplifying payment processes and automating order management, retailers can focus more on their core business functions, such as marketing and customer engagement, which are crucial for growth.

As the digital marketplace grows, staying ahead of the competition means adopting tools that not only facilitate transactions but also support business scalability.

This is where the combination of Syncee and Stripe becomes a game-changer, empowering retailers to efficiently manage both their payments and their supplier relationships.

By adopting a comprehensive platform like Syncee, retailers can leverage the full potential of modern payment solutions, enhancing their operational efficiency and customer satisfaction.

Find more information about Stripe on their official website.

Overall, as businesses increasingly shift to online sales, integrating a top-tier payment processor like Stripe can significantly impact their success, helping them to capture more customers and boost sales.

For those looking to embrace dropshipping, Syncee alongside Stripe is an ideal pairing, providing the tools necessary for retailers to thrive in an ever-evolving ecommerce landscape.

How Can Retailers Pay for Orders in Syncee?

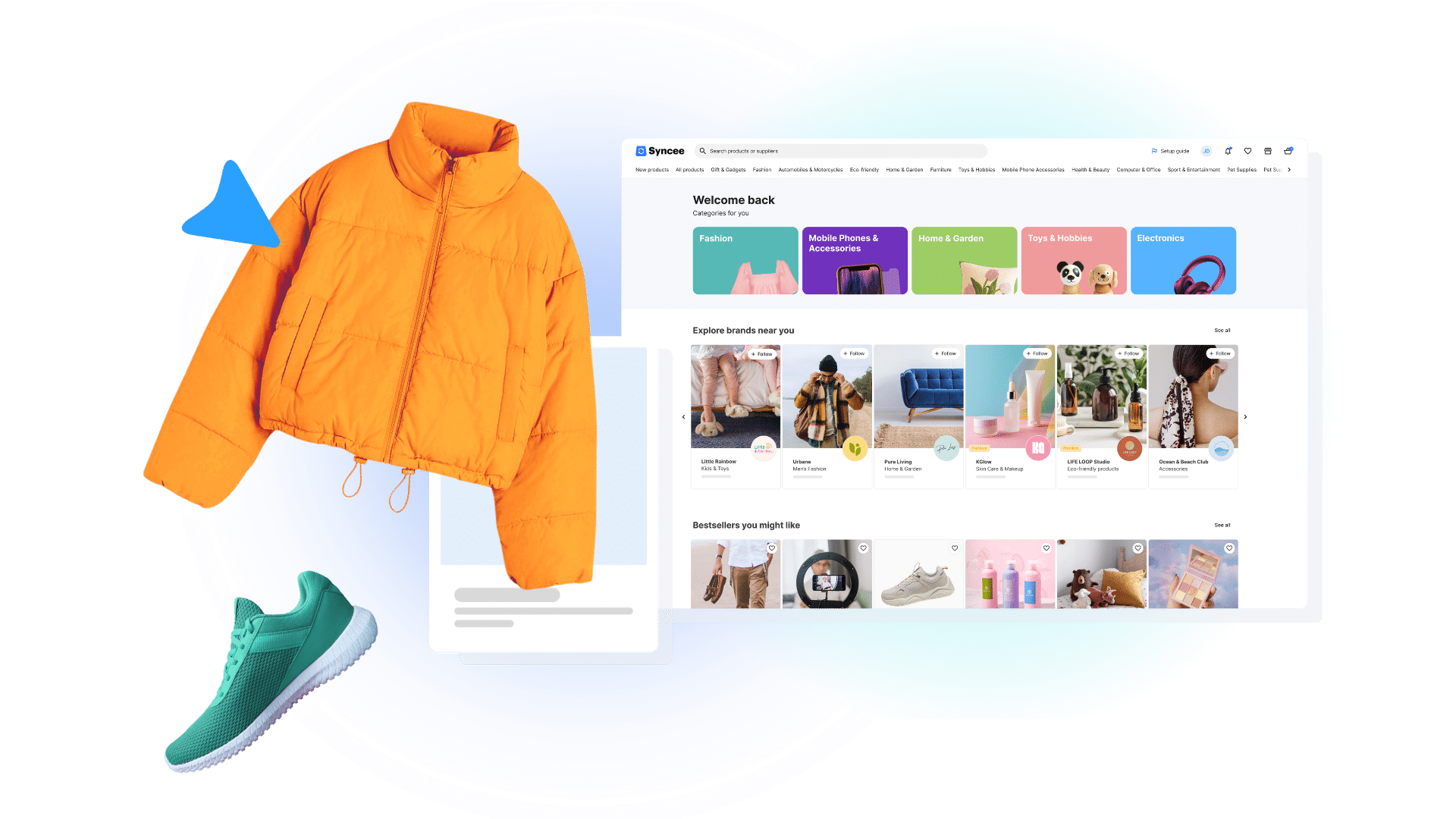

Retailers can browse among products and suppliers on the Syncee Marketplace. They can access Syncee’s Auto Order feature at those suppliers whose products are marked with a green “Auto Order” label.

It means that Syncee will automatically synchronize those orders’ details directly to the supplier that has been paid by the retailer in Syncee through a secure channel.

Retailers can use PayPal, Stripe and credit card to pay the order—those credit cards can be used that are accepted by PayPal: Visa, MasterCard, Discover, American Express.

Retailers can manage orders with Auto Order one-by-one or in bulk.

How Can Suppliers Receive Order Revenue?

Suppliers who have their products synchronized into the Syncee Marketplace directly from their online store can enjoy Syncee’s Auto Order feature. It means that if the retailer pays the order in Syncee, the order details will be synchronized into the supplier’s store automatically, and the order amount will also be sent through a secure channel. Then the supplier has to start fulfilling the order.

Suppliers can accept payments via PayPal and/or Stripe.