On July 30, 2025, the Trump administration issued a major executive order officially announcing that the de minimis exemption is over for all international shipments entering the United States, effective August 29, 2025. Until now, the exemption had permitted commercial parcels valued at $800 or less to enter duty-free, a policy heavily utilized by overseas retailers, especially from China and Hong Kong. This is a major change for dropshipping businesses that rely on international suppliers. It means that dropshipping is making a turn, and it is going local.

According to the official White House fact sheet, this decision is based on national security, border control, and economic policy concerns. The exemption was, according to the administration, exploited for tariff avoidance, and in some cases, for moving illicit goods. This latest move builds on a series of earlier actions: in May 2025, the exemption was already ended for shipments from China and Hong Kong; now it applies to all countries as the de minimis exemption is over soon.

What Is the De Minimis Exemption & Why It Ends?

The de minimis exemption let international sellers ship goods worth under $800 to US customers without paying import duties. That’s how platforms like Temu and Shein kept prices so low and delivery relatively fast. And this is why many dropshippers were working with AliExpress dropshipping, which is coming to an end now.

But now, the US government says that exemption has been abused—by avoiding tariffs, flooding the market with low-cost goods, and even enabling the movement of illegal substances in small parcels. The exemption helped move over 1 billion low-value packages into the US in 2024 alone. Many of them slipped past customs, completely duty-free. That’s now coming to an end with the announcement of new US tariffs in August—and the fact that the de minimis exemption is over.

What’s Changing on August 29?

When the de minimis exemption is over, here’s what dropshipping businesses (and online retailers in general) will face:

- Every international package will be taxed, regardless of value.

- Postal shipments will get hit with flat fees ($80–$200 per item).

- Private couriers (like FedEx and UPS) will apply percentage-based tariffs.

- And by July 1, 2027, the de minimis exemption will be fully repealed by law, not just executive order.

In short: low-cost imports are getting more expensive, slower, and harder to manage.

What will the new duties look like?

For packages shipped through the international postal system, there will be two ways duties can be applied, depending on how the item is shipped and where it comes from—now that the long-standing tariff exemption has been removed:

- Value-based tariffs (ad valorem): After the transition period, each package will be taxed based on its value and the standard tariff rate for its country of origin. These rates are determined under the International Emergency Economic Powers Act (IEEPA).

- Flat-rate tariffs (specific duty): For the first six months after the policy takes effect, there will be an option to pay a fixed fee per item, ranging from $80 to $200, again depending on the origin country’s tariff status.

Once that six-month window ends, all shipments must switch to value-based tariffs—meaning every product’s price will directly affect how much duty is owed.

How Will This Affect Dropshipping?

The suspension of the de minimis exemption has widespread implications for the ecommerce ecosystem—particularly for dropshipping businesses and small online retailers that depend on low-cost international suppliers.

If you’ve built your store around low-price products from overseas, this policy shift could hit hard.

You’ll have to:

- Recalculate your costs and profit margins.

- Handle import paperwork and customs delays.

- Possibly deal with unhappy customers facing longer shipping times or surprise fees.

It’s not just a headache. It’s a signal that international dropshipping is no longer the easy, cheap option it used to be as the de minimis exemption is over.

However, dropshipping is not dead!

Why the Future of Dropshipping Is Local

With the fact that the de minimis exemption is over, more retailers are shifting to local dropshipping. Here’s why it’s becoming the smarter choice:

- No US tariffs — Domestic products don’t face customs duties.

- Fast delivery — US-to-US shipping is simpler and quicker.

- Easier returns — No more shipping items across oceans.

- Predictable logistics — No surprises with fees or delays.

- Supports local businesses — Which more customers care about, too.

If you’re looking to grow a long-term ecommerce brand, working with US-based suppliers just got a major boost.

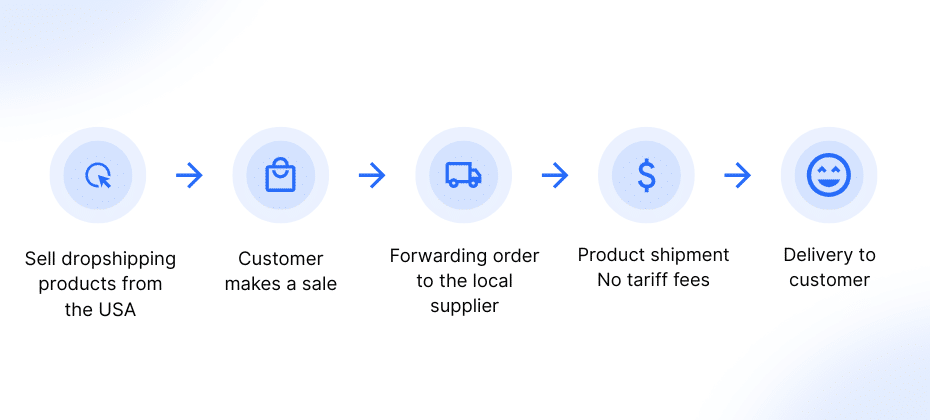

How Syncee Helps Dropshipping In This New Era

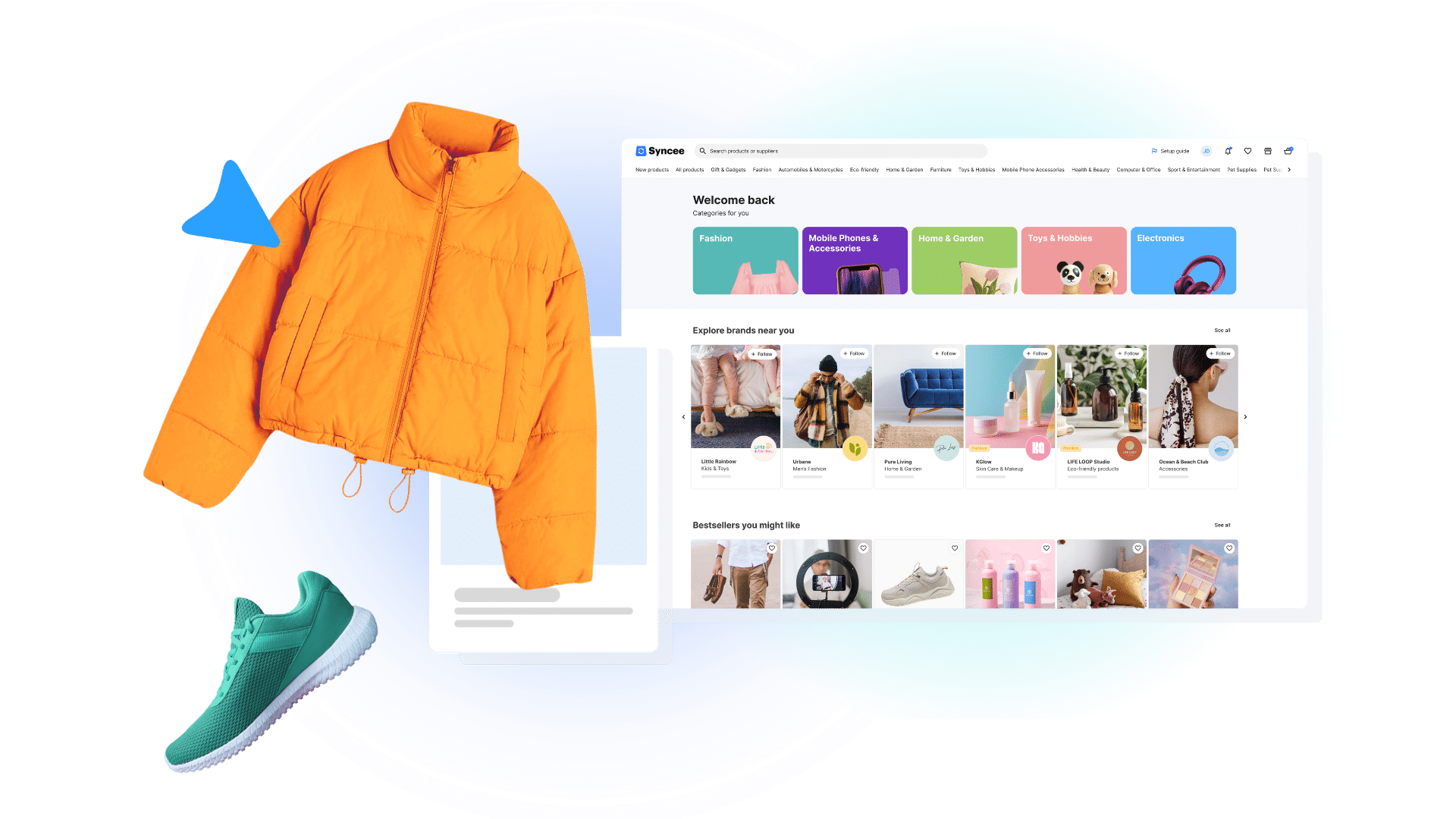

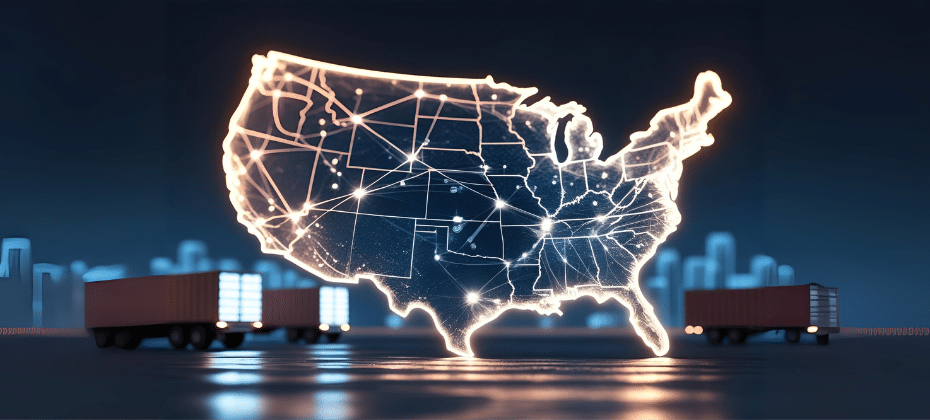

Platforms like Syncee make it easy to find and work with US-based suppliers—no importing, no US tariffs, and fast shipping from within the country.

Syncee is a collective, global dropshipping and wholesale marketplace available on Shopify and all major ecommerce platforms. It means you can find local suppliers for your dropshipping business wherever you are, as we have always and continue to support local collaborations between retailers and suppliers.

With Syncee, you can:

- Avoid the US tariff chaos now that the de minimis exemption is over.

- Enjoy fast, reliable shipping from US warehouses to US customers.

- Discover thousands of US brands.

- Access a wide product range, from fashion and beauty to pet products, home décor, electronics, and much more.

For suppliers, Syncee is also a great choice as they can add their products to Syncee’s marketplace where local retailers will find them.

Enjoy Personalized AI Product Recommendations on Syncee

Dropshipping success starts with choosing the right products. On Syncee, AI-powered product recommendations help you:

- Discover trending, profitable items matched to your store.

- Get personalized suggestions based on your preferences and customer needs.

- Spend less time browsing and more time growing your business.

Now that the de minimis exemption is over, staying ahead means working smarter—and Syncee’s AI helps you do just that.

Final Thoughts

This summer marks a turning point in ecommerce. The de minimis exemption is over, and that changes the rules for global trade, online retail, and especially for dropshippers.

If your store still relies on international suppliers, now’s the time to think local.

Local suppliers. Fast shipping. No US tariffs. That’s the future of dropshipping, and it’s already here.

Frequently Asked Questions

What does it mean that the de minimis exemption is over?

The fact that the de minimis exemption is over means all international shipments to the US—no matter the value—will now be taxed. The previous $800 duty-free limit no longer applies.

How are US tariffs applied now that the de minimis exemption is over?

For six months, parcels may face flat fees ($80–$200/item). After that, value-based tariffs will apply, based on the item’s country of origin.

How can dropshipping stores avoid issues with US tariffs?

Work with US-based suppliers to skip tariffs and customs delays. Local dropshipping is now the faster, simpler, and more profitable option.